Pop Up Card Craft

This easy pop up greeting card can be customized for any taste or occasion!

Materials

-

- Card Stock (or a piece of card folded in half)

-

- White paper (or paper of choice)

-

- Colorful patterned paper or use pens to decorate cake layers and make candles

-

- Scissors

-

- Glue stick

How to

Create 12 candles with flames

- Using patterned paper, cut out candles 1 ½ inches long and 1/2 inch wide.

- Using yellow paper or colored paper, cut small circles with points for flames.

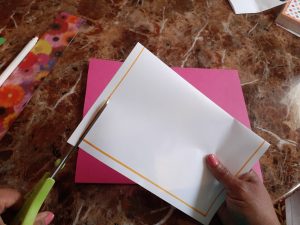

Prep your card

- Using card stock as a guide, cut the white paper down a little to create a nice frame.

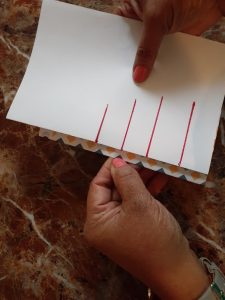

Cut out the cake’s tiers or layers

- Fold white paper in half.

-

- Make 4 cuts:

2 long cuts (2 ½ inches)

1 medium cut (2 inches)

1 small cut ( 1 ½ inch)

- Make 4 cuts:

- Cut on red lines.

- Divide this cake space into three equal parts along the folded spine.

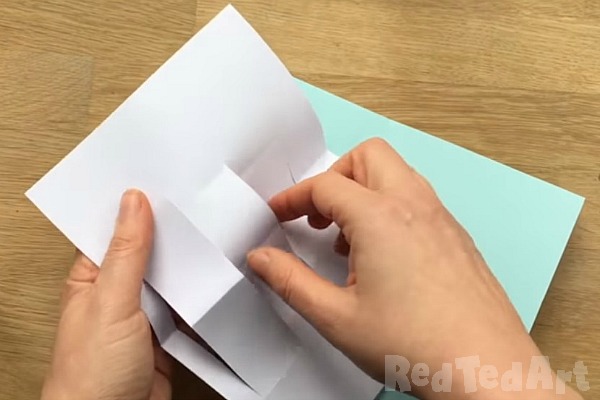

- Fold them over.

- Unfold the paper and “reverse the crease”.

Assemble and decorate

- If using colorful paper, glue it on one cake layer at a time and press to smooth.

- Glue the white inside edges to the card stock, one side at a time. DO NOT GLUE DOWN THE CAKE LAYERS.

-

- Glue candles inside each cake tier or layer.

-

- Glue a flame on each candle.

- ENJOY!