Exercises for Fall Prevention with Telly

Practice these exercises to help improve your balance and coordination.

Practice these exercises to help improve your balance and coordination.

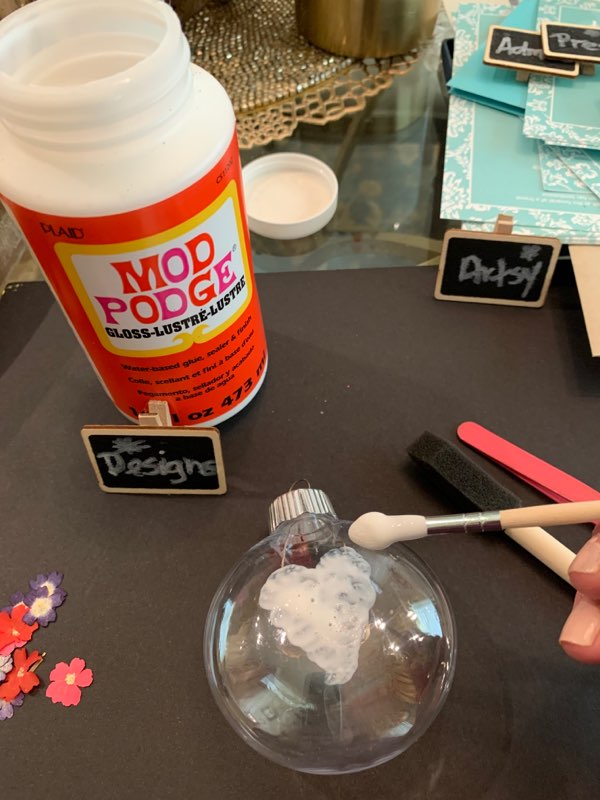

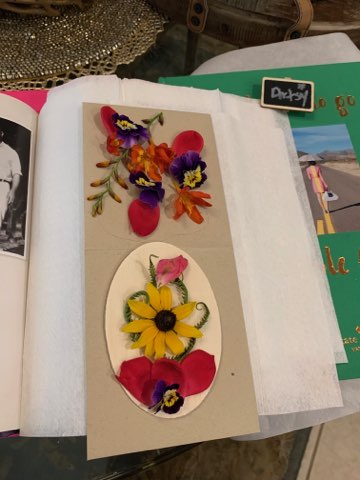

Use pressed flowers to decorate vases, ceramic tiles, clear ornaments, candles or picture frames. Create a special handmade gift for a loved one or preserve special-occasion flowers.

Action Needed for Social Security Beneficiaries with Dependents and Who Do Not File Tax Returns to Receive $500 Per Child Payment.

Social Security retirement, survivors, and disability insurance beneficiaries with dependent children and who did not file 2018 or 2019 taxes should immediately go to the IRS’ webpage at www.irs.gov/coronavirus/non-filers-enter-payment-info-here and visit the Non-Filers: Enter Payment Info Here section to provide their information.

They need to act by Wednesday, April 22, in order to receive additional payments for their eligible children quickly. By doing so, they may receive the $500 per dependent child payment in addition to their $1,200 individual payment. We strongly encourage completing this process promptly, in order to avoid having to wait to file a tax year 2020 tax return to obtain the additional $500 per eligible child.

SSI recipients need to take this action by later this month; a specific date will be available soon.

Social Security beneficiaries and Supplemental Security Income (SSI) recipients with no qualifying children under age 17 will receive their Economic Impact Payments soon, and do not need to take any action.

Those with Direct Express debit cards who enter information at the IRS’s website should complete all of the mandatory questions, but they may leave the bank account information section blank as Treasury already has their Direct Express information on file.

For more information, please read the new press release from Social Security Commissioner Andrew Saul.

Take a moment to de-stress and let Carly lead you through a few minutes of guided relaxation.